Keywords

Bank Transaction, ACM, Elderly, Greece

Introduction

Banking transactions are becoming increasingly automated, in parallel to the frenzied progress of technology. New alternative distribution networks (ACMs, internet, mobile telephony) are interconnected, provide access to the central information systems of banks and offer a wide range of possible applications. Automatic cash machines (ACMs) and their use are subject to intense competition on an international level, as these transactions are more accessible to customers but also drastically reduce the operational cost of banking (Miller and Noulas, 1996, Kokomeli, 1995, Gortsou, 2001).

Elderly people face income problems, as their income is usually reduced upon retirement and they are obliged to practice better money management (Kozier, Erb, Oliveri 1991). Since in recent years, pensions are paid to pensioners through bank accounts, they have to be familiar with the services provided by banks for money withdrawal through ACMs as well as other banking services provided by ACMs. Nevertheless, elderly people are not experts in using new technologies and this sometimes produces difficulties in the use of ACMs by elderly people.

Thus, it was interesting to explore the views of members of Open Care Centres for the Elderly regarding the use of the ACM machines in the greater Athens area, with the aim of giving some ideas to banking authorities on how to help the elderly access easier and convenient banking.

Basic Data regarding the Greek Banking System and the Use of Automatic Cash Machines (ACMs)

Modern banking services (and particularly sales and advisory services) are not likely to be standardized to the extent that they would be replaced entirely by ACMs. This would have significant (and very widespread) repercussions in terms of cost, internationalization of ? competition conditions, employment and pressure on the existing arrangement of labor relations. Despite the reduction of transaction costs and the potential advantages that the EMU offers banks, they stand to lose income them from their present international activities and transactions. It is a considerable burden in terms of the cost of adapting their systems (conventions, accountant, software, transactions, ACMs) in to the euro, it intensifies competition among them inside and outside the EU, it creates new and still more powerful pressures to provide for rearrangements, fusions, internationalization of operations, technical and organizational changes as well as substantial curtailments of functional costs, wages and benefits to workers.

Attempting an approach within the National Bank of Greece, based on the elements that concern transactions via ACMs, we concluded that the ACMs that serve the National Bank of Greece substituted the work of some 1700?2500 tellers. This is supported by the calculation that an average teller carries out a daily number 100 to 300 transactions and that, by comparison, the daily number of electronic network ACM transactions of the National Bank of Greece is over 100,000. The cost of each transaction via an ATM, according to studies we consulted, fluctuates from 12?23% of the cost of a transaction via a cashier, a fact that is of particularly weight for banking enterprises making an effort to reduce the cost of labor.

ACMs have been used in Greece since the 1980’s. Greek consumers were initially hesitant to use them, but with time consumers became more and more familiar with them, and in particular they became increasingly popular with younger people who are more comfortable with using modern technology (Archontakis and Kyriakopoulos 1997).

The number of ACMs in Greece was increased from 1,216 in 1994 to 1,767 in 1996 (an increase of 45.3%), thus considerably reducing the functional cost of banks and giving consumers the possibility to carry out transactions beyond banking hours and holidays (Alexakis et al. 1995, Spathis and Kosmidou, 1999, Athanassopoulos, 1997). For example, the approximately 240 ACMs that functioned in the National Bank in 1993 were quite effective, reducing by 12?23% the cost of corresponding transactions via a teller. Today, 1/4 of daily transactions go through ACMs. (Noulas, 1999, Provopoulos and Kapopoulos, 2003, Lazaretou, 2004).

Despite the introduction of new banks and branches of foreign banks to Greece after the 1960’s, almost the entire banking system was characterized by strong state control and monitoring by the Greek Central Bank (Mathioudaki, 1995, Vassiliou, 1993, Soteriou and Zenios 1999). The number of banks and their network was substantially increased, especially after the 1990’s. Today, apart from the Greek Central Bank, there are 40 commercial banks (20 Greek and 20 foreign banks, mainly branches of multinational companies) and nine specialized banks (three developmental, three housing, one agricultural, one postal savings bank and one savings and loan fund). What is also particularly significant is the growth of the banking network over the past few years within the network of Greek banks, which now extends beyond Greece to many countries abroad, while the network of foreign banks is limited, on the whole, to the three larger cities (Athens, Piraeus, Thessalonica) (Thomadakis, 1995, Armagou, 1999, Brissimis and Kosma, 2005).

ACM Services

• Cash withdrawals

• Cash deposits

• Deposits of checks

• Account balance information

• Payment of credit card bills and transfer of balances due

• Payment of instalments and consumer loans and transfer of balances due

• Payment of Greek Telecom bills

• Payment of Greek Electric Co. bills

• Payment of Vodafone cell phone bills

• Payment of TIM cell phone bills

• Payment of OTENET (Greek Telecom internet server) bills

The growth of management clientele systems (Customer Relations ? Management) with the creation of a database for each banking customer or groups of customers has already been applied to ACMs. The growth prospects for automatic cash machines in terms of numbers as well as transactions are significant in our country.

According to statistics from the National Bank of Greece, a total of 3,547 ACMs puts this country in 15th place in the classification of European countries based on the indicator "ACM per resident", pointing to a substantial growth margin. Our country allocates one ACM per 2,980 residents, while in Spain, which holds first place in the same classification, there is one ACM per 952 residents, in Portugal one ACM per 1,237 residents, etc. Greece is installing new ACMs more at a more rapid rate than any other country in Europe at 15.7% (from December 1998 to December 1999). The National Bank of Greece, with more from 800 subsidiaries and a market share of market exceeding 23%, has the most ACMs in our country, followed by Alpha Bank, the Commercial Bank of Greece, EFG Eurobank Ergasias, The Agricultural Bank of Greece, Piraeus Bank, etc.

Although no general statistics are available, cash withdrawal is estimated to amount to approximately 70% of all ACM transactions, while 25% are concern requests for information about account balances (Karamouzi, 1996, Archontakis and Kyriakopoulos, 1997).

More and more services continue to be offer via ACMs, thus ensuring consumer friendly handling of transactions while providing the requisite security as well. An excellent example of this is the fact that it has recently become possible to pay VAT via ACMs. However, since it would mean quite a big step in expanding the range of new banking transactions, it is safe to assume that it is still premature to expect a large?scale development of ACM transactions which are not of a purely banking character, e.g. purchase railroad and air tickets, etc.

The Elderly Population in Greece

The European Union (EU) faces new challenges, as its aging population is rapidly increasing (OECD, 2004). The elderly population in Greece has now reached 26% of the active population, and is thus one of the highest in the EU, while in 2002, life expectancy reached 78.1 years (80.7 years for women, 75.4 years for men) (OECD, 2004). There were elderly people 1,915,000 in the year 2002, i.e. 18.1% of the total Greek population, while elderly people belonging to the 65?69 age group made up 5.6% of the general population, those 70?74 years of age accounted for 5%, those 75?79 for 3.6%, and finally, those over 80 for 3.8 % (OECD, 2004).

The Open Care for the Elderly Centres in Greece

In the early 1980s, the first KAPI (abbreviation in Greek for “Open Care for the Elderly Centres”) started functioning in Greece. KAPIs have helped elderly citizens to remain active participants in the society, a need is even greater in contemporary Greek society, in which the traditional forms of care for older people are declining due to changes in societal trends. However, it has to be mentioned that in KAPIs gather usually elderly people who do not have any kind of disability (Teperoglou et al 1990).

Today a considerable amount of KAPIs are functioning across Greece. Local authorities assumed responsibility for KAPIs, from the early stages; however the State was the main financial contributor, while in recent days municipalities have taken over the responsibility of financing KAPIs. The most important contribution of the KAPIs in the elderly care is that they enable old people to remain at their homes, while at the same time receive care by health and welfare professionals. Furthermore, KAPIs give opportunities to elderly people to gather together, to meet other senior citizens and to participate in various social activities organised by the KAPIs staff (Daniilidou et al 2003).

Money Management and Elderly People

The rapid demographic and economic changes that Greece faced in the second half of the 20th century changed the traditional patriarchal family structure to nuclear family (Teperoglou 1980, Mousourou 1984, Sapountzi, Dimitriadou, Minassidou 1992). A considerable number of frail elderly who despite the fact that most of them suffer from chronic illnesses, live longer lives and most of them want to remain living in their own homes for as long as possible (Sapountzi, Dimitriadou, Minassidou 1992). A considerable number of frail elderly people, despite the fact that many of them suffer from chronic illnesses, live longer lives and most of them wish to remain living in their own homes for as long as possible. Furthermore, as life expectancy has increased, more and more elderly people live with their spouses or alone, and are obliged to deal with money management, a function that was previously taken on by the younger generation of the family.

Money management can often prove a difficult task, as elderly persons may make disturbing mistakes with household bills. In many countries, lawyers, banks and other money managers are available to moderate or low?income elderly persons to assist them in finding the appropriate service (https://louisiana.gov/elderlyaffairs, https://www.coastlineelderly.org/ Visited 2?3?2007). However this is not the usual practice followed in Greece.

In a study conducted at Ohio State University, it is suggested that it is beneficial to reach low?income elderly persons and provide them with money management information. Sources suggested that radio and TV programmes, community workshops or seminars, home study courses, and other printed materials might not be successful. Furthermore, respondents who indicated that they did not search for or use financial management information gave several reasons for this, such as physical limitations (bad eyesight), lack of understanding, reliance on religious beliefs, or lack of interest, while some of the respondents felt they didn't have enough money to warrant using financial management information (https://www.joe.org/joe/1990fall/a3.html. visited 2?3?2007).

Aims of the Study

The aims of this study were:

1. To get information about the knowledge among members of the Open Care Centres for the Elderly situated in the greater Athens area about the banking services available through ACM.

2. To achieve an insight into the use of the ACM for specific banking services on the part of members in Open Care Centres for the Elderly situated in the greater Athens area.

Study Population and Methods

Setting and Participants

The participants of the present study were members of nine Open Care Centres for the Elderly situated in the greater Athens area. All of these members of Open Care Centres for the Elderly were eligible to participate, but for the present study a convenient sample of 250 participants were invited to do so. Elderly persons who were interested in participating were given further information about the study, including the confidentiality issue, and were subsequently asked once again if they still wished to participate. However, 36 of them refused their participation in the study for personal reasons and thus the final sample was made up of 204 participants.

Questionnaire

A 15?item?questionnaire was used, especially designed to investigate the use of ACM bank machines by members of Open Care Centres for the Elderly. The first part of the questionnaire contained four questions designed to elicit information on demographic and educational characteristics of the participants. The second part contained two scales of 5 points ? Likert format – the first comprising four questions the second five. The first one was designed to elicit information about participants’ knowledge of the services provided by ACMs and related issues, and the second for eliciting information about the use of ACM bank machines for specific banking services. One more question was included, asking participants about the reasons that keep them from using ACMs, as well as final one, which was open ended, asking participants what banks should do in their opinion in order to help them use ACM more frequently. The questionnaire retained the anonymity of all participants. A pilot test of this questionnaire was carried out before its implementation within our study. Cronbach’s Alpha was good for both the scales and ranged from 0.76 on the first scale to 0.79 on the second scale.

Statistical Analysis

All statistical analyses were carried out using SPSS for Windows (Release 11). For the purpose of data presentation, descriptive statistics were used and a regression analysis was applied with the questions included in the scales as dependant variables and age and education as independent variables.

Results

Demographics

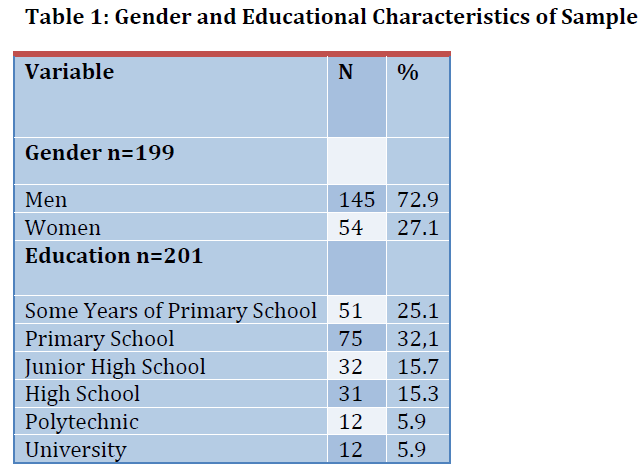

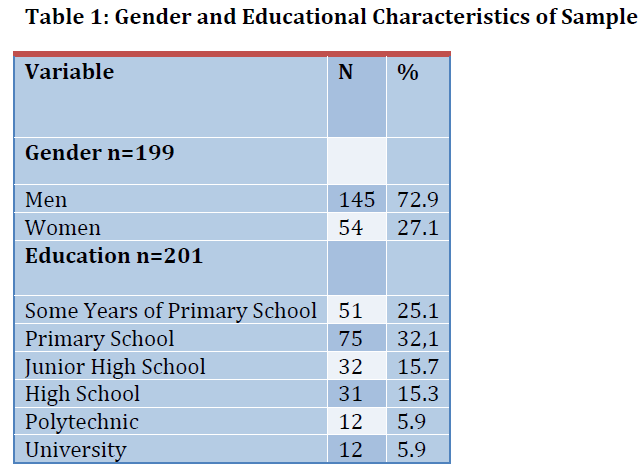

Table 1 presents the distribution of the sample according to demographic, educational and employment characteristics.

The majority of participants (n=145, 72.9%) were male. As to the age of the population we studied, the mean age for the men was 71.66 ±5.13 years, and 70.04±6.46 years for the women. All participants were pensioners.

Descriptive statistics

Familiarity with ACMs

Regarding the knowledge of the participants regarding which banking services are available through ACMs, 79 of the participants (38.7%) stated that they had no idea about these, 74 of the participants (39.2%) stated that they were aware of a few of the available services, 29 (14.2%) stated that they knew of some of the available services and only 12 of the subjects (5.9%) stated that they knew of all the banking services that are available through ACMs.

About half of the sample (n=97, 48%) stated that the never used ACMs, 53 of the participants (26.2%) stated that they rarely used them, 17 subjects (8.4%) stated that they did so quite frequently, 23 (n=11.4%) said they did so frequently and only 12 declared that (n=5.9%) they always used ACMs. Reasons For Not Using the ACMs

Regarding the reasons that kept them from using ACMs, only 100 (49%) of the participants answered the question, with 82 subjects (40.2% of the total sample) stating that they did not know how to use ACMs, three subjects (1.5%) stating that they had difficulties doing so, eleven subjects (5.4%) saying that they did not use ACMs because they were afraid of becoming victims of a crime while using an ATM, while 4 subjects (2%) said that they did not use ACMs for other reasons without stating them.

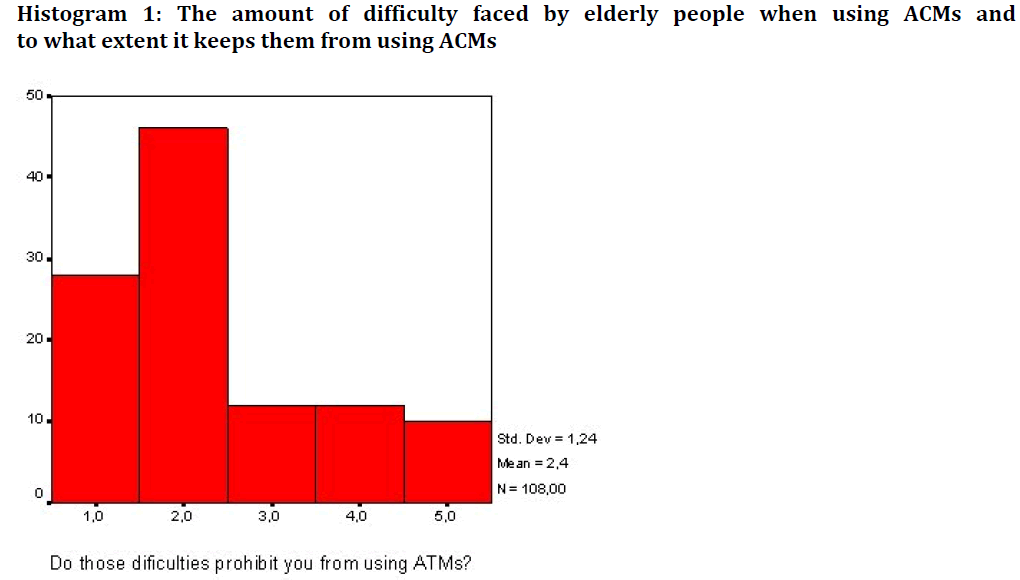

Difficulties With ACM Use

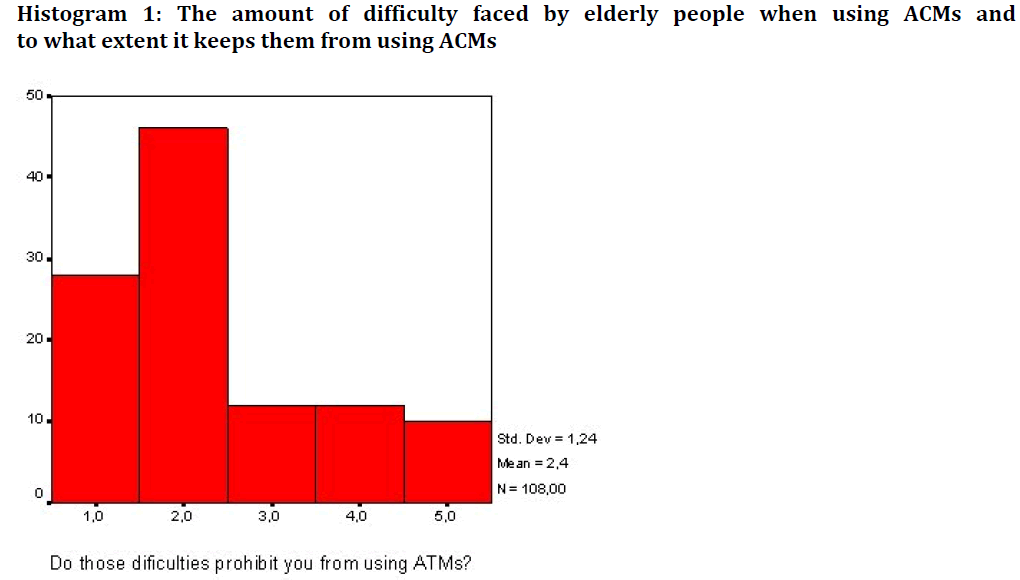

Those who used ACMs, no matter how frequently (n=105), were asked if they faced any difficulties in using them. Only 20 (19%) subjects stated that they never had much trouble, while 58 (n=54.5) stated that they never did. However, eleven subjects (n=10.5) faced difficulties quite frequently, nine (8.5%) frequently and 8 (7.5%) stated that they always had trouble when they tried to use the ACMs. The participants who use ACMs responded to the question “Do these difficulties keep you from using ACMs?’ as presented in histogram 1 (1 never, 2 rarely, 3 many times, 4 frequently, 5 always).

Histogram 1: The amount of difficulty faced by elderly people when using ACMs and to what extent it keeps them from using ACMs

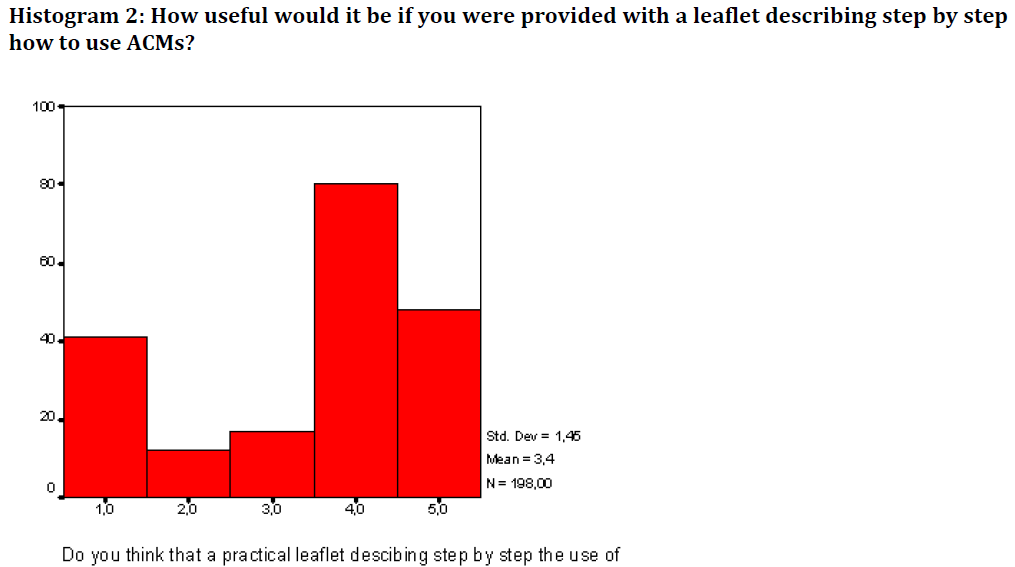

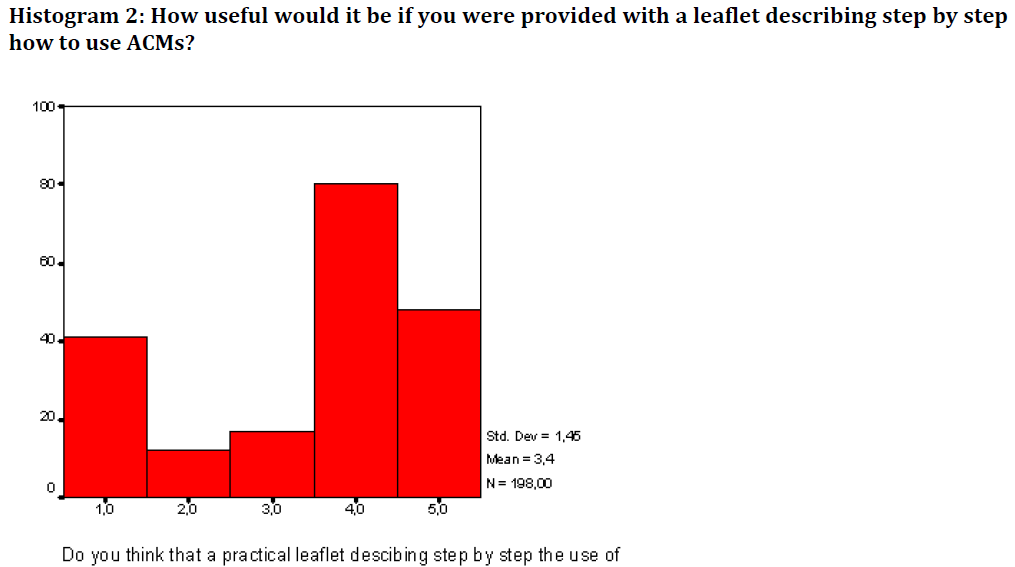

Participants’ responses to the question “Do you think that it would be useful to be provided with a leaflet describing step by step how to use ACMs?” (1 don’t know/ don’t wish to answer, 2 not at all useful, 3 useful in some way 4, quite useful, 5 absolutely useful).

Regarding the use of the ACMs for money withdrawal from their account, only 15 (7.4%) always used ACMs, 22 (10.8%) used them frequently, 20 (9.8%) many times, 26 (12.7%) rarely, while the majority of participants (n=118, 57.8%) never used ACMs for money withdrawal.

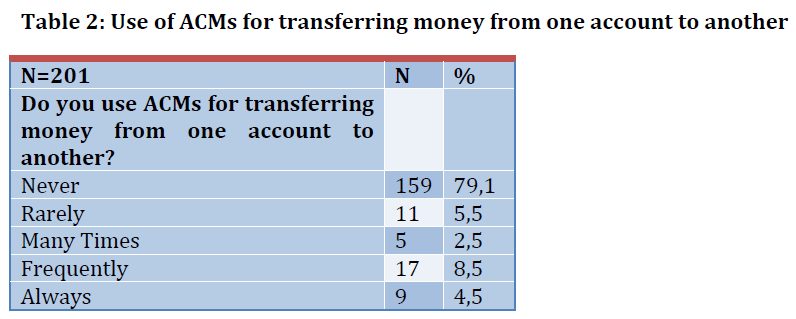

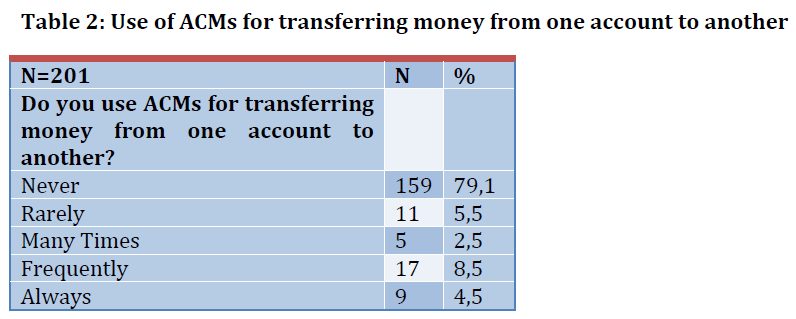

The subjects responded to the question “Do you use ACMs for transferring money from one account to another?’ as presented in table 2.

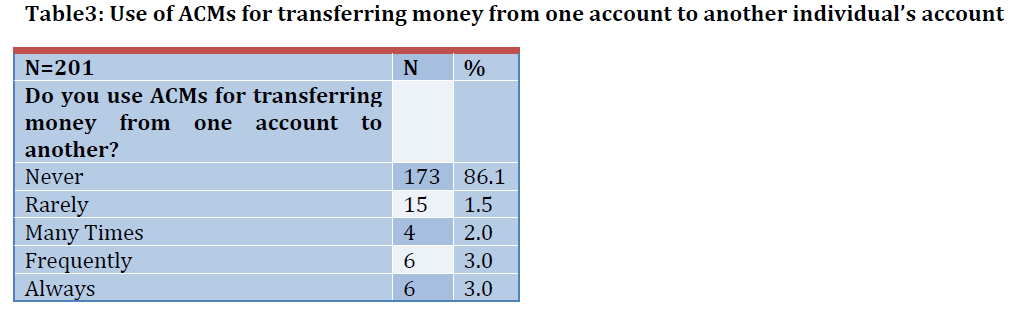

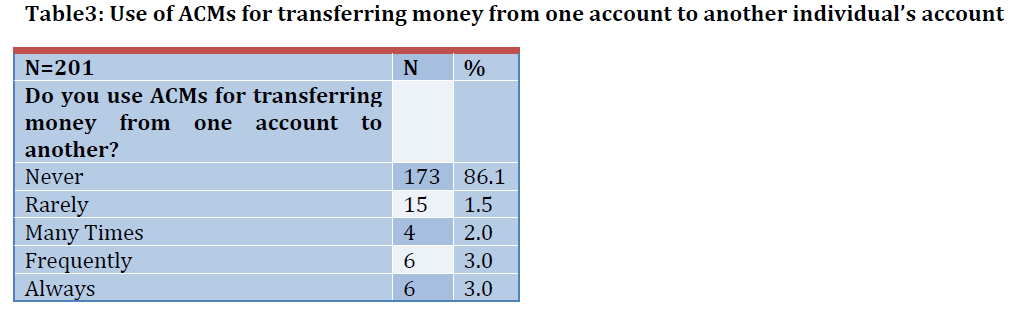

Subjects answered the question “Do you use ACMs for transferring money from your account to another individual’s account?”, as illustrated in table 3.

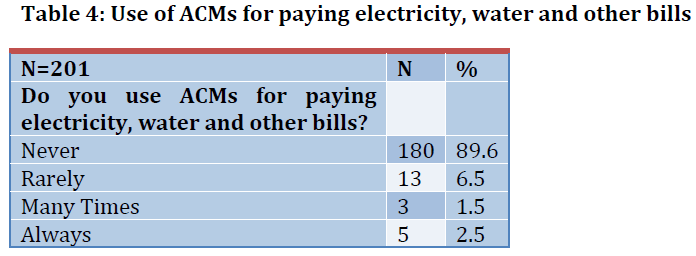

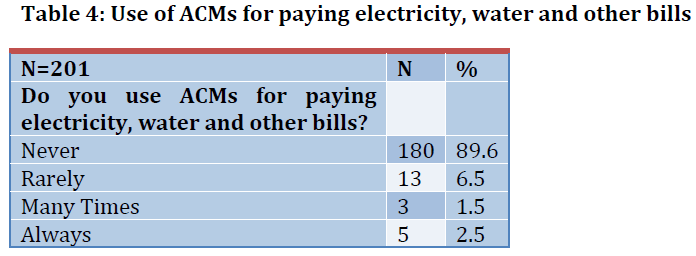

Subjects also provided information on how frequently they used ACMs for paying electricity, water and other bills, and their answers are illustrated in table 4.

Statistical Analysis

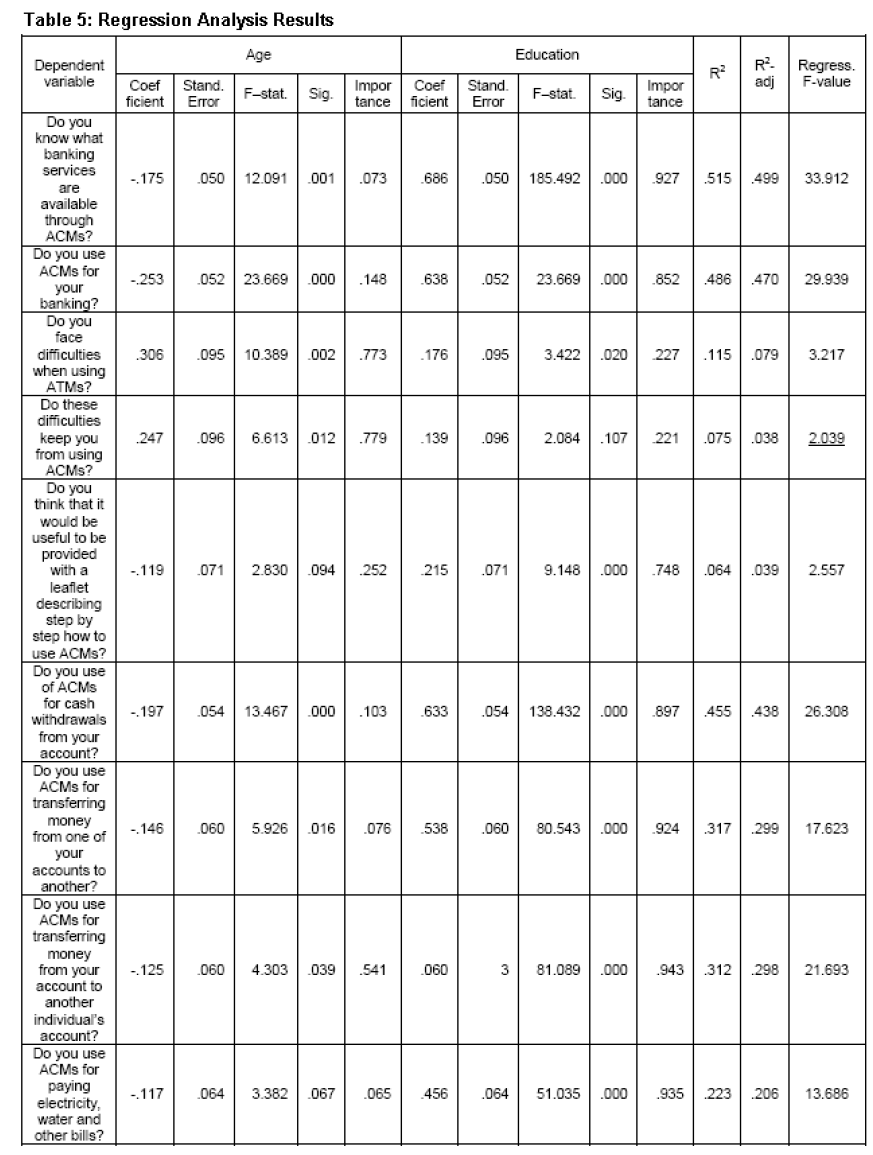

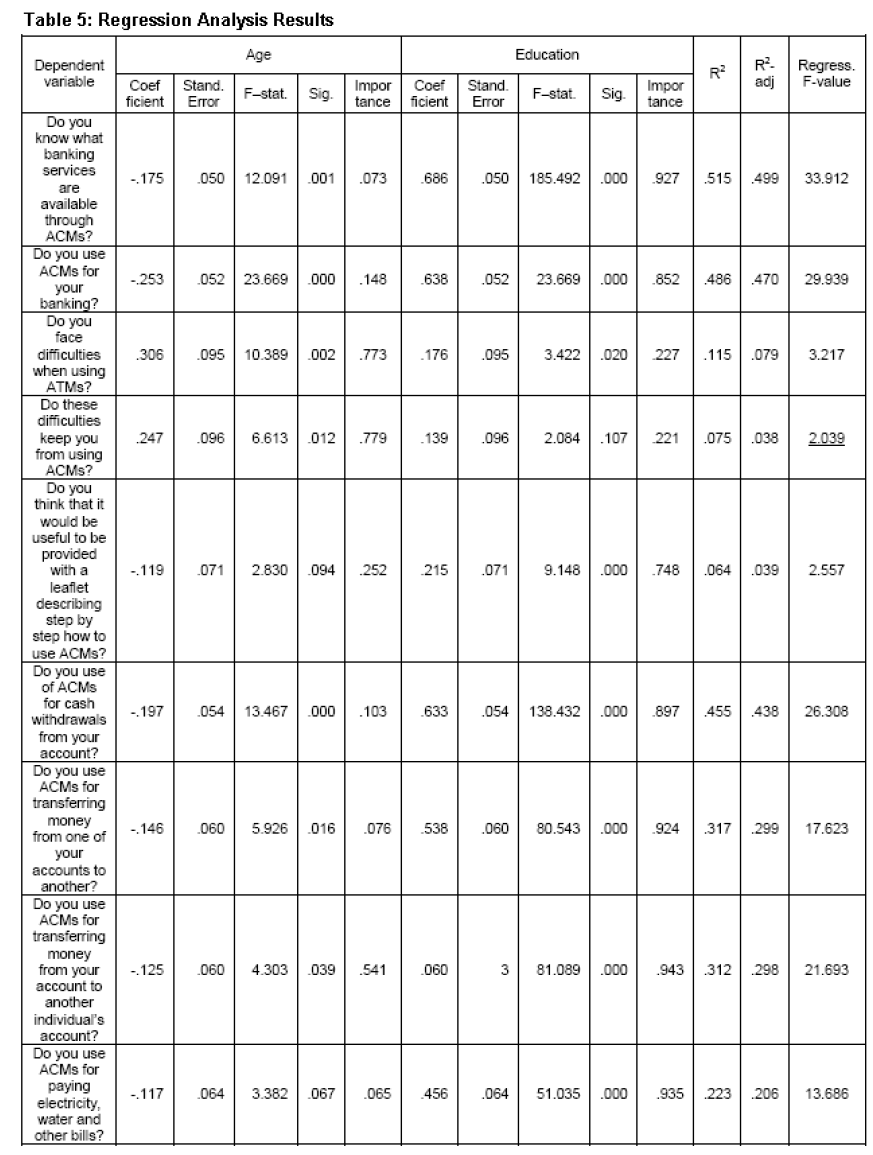

A regression analysis was used, the dependent variables being the questions included in the questionnaire, while and the independent variables were age and education. The results obtained are presented in table 5.

Discussion

It would be useful to discuss several concerns, which this study was faced with before its results are interpreted. One of our concerns is that the research was carried out in Athens in nine of the Open Care for the Elderly Centers. Hence, the results cannot be generalized. However, Athens is the capital of Greece, nearly half of the Greek population lives in Athens and the study can give at least an impression of the knowledge that elderly people have about ACMs and the use they make of available banking services. Furthermore, one of the strengths of the study, which also makes it useful, is that it is the first Greek survey on these particular issues.

As can be seen from the results obtained, the vast majority of participants have no or very little idea of the banking services available through ACMs. Moreover, about half of the sample stated that they never used ACMs, the main reason for this being that they do not know how to use them. About half of those who use ACMs face difficulties in using them. Keeping in mind the problems common to most senior citizens, these difficulties are most probably due to a reduced capacity of perception, as well as restricted visual facilities, motor difficulties in using an ACM keyboard, etc. Clearly, our respondents belong to a generation that is not familiar with ACM usage because these machines have only been introduced in Greece over the past few years.

An interesting finding is that the main reasons keeping participants from using ACMs was firstly that they don’t know how to use them, while some of the subjects stated that they did not use ACMs because they were afraid that they might become a victim of crime while they doing so. Another interesting finding is that only 19% of those who use ACMs stated that they never faced any difficulty, while difficulties in using ACMs keep most of the elderly from using them. Furthermore, a considerable number of the participants in histogram 2 have the opinion that it would be useful to be provided with a leaflet describing step by step how to use ACMs. It could certainly be argued that is the responsibility of the banks to find ways to help these people overcome their problems, since after all they are their customers.

Histogram 2: How useful would it be if you were provided with a leaflet describing step by step how to use ACMs?

Regarding the actual use of ACMs, the majority of participants (n=118, 57.8%) never use ACMs, not even for cash withdrawal, while the numbers of users for other services is even lower. The regression analysis we applied (table 5) revealed that the higher their age, the less respondents knew about the services provided through ACMs and the less they used ACMs, while the higher the education of subjects was, the more they knew about the services provided through ACMs and the more they used ACMs. Difficulties in using ACMs are also positively related to age (the higher the age the greater the difficulties), while the desire to be provided with a leaflet describing step by step how to use ACMs is not influenced by age. However, educated participants were more likely to express a desire for information in a useful leaflet about the use of ACMs. Moreover, the use of various banking services provided through ACMs is negatively related to age and positively related to educational level.

Conclusions

It is a fact that in demographic terms – and this applies to the whole world, but in particular to Greece – the increase of in the share of elderly persons in our population is very marked, and a phenomenon that modern societies are called upon to deal with (OECD, 2004). In this area as well as in many others, it is especially important to make an effort overcome problems calling for solutions in terms of improved access and use of modern technology on the part of elderly people. According to the findings of the present study on the use of ACMs by elderly people, we can conclude that: a problem does indeed exist in Greece with respect to the use if modern technology on the part of senior citizens, and in this particular case regarding ACMs. The chief reasons for this problem, as shown in this study, are a lack of knowledge / information about how to use ACMs, as well as the fact that elderly persons fear for their safety during ACM use – and this applies in particular to the group with a lower level of education, who make up 57,2% of our sample (table 1). This becomes even more obvious when regarding the use of ACMs and their services, whether these are simple cash withdrawals or other more complicated services. In this connection, let us not forget that the elderly will always tend to lag behind with respect to new functional and systemic developments, since these are usually extremely rapid and in the hands of young technocrats. However, we would argue that with the passing of time, there will very few uneducated elderly people, since the vast majority of younger generations has had access to at least basic compulsory education, and we can also assume that their familiarity with new technologies will be situated on a much better level, allowing for much more easy usage. Even when the generations with these specific problems are long longer with us, though, banks, as institutions, will still need to take responsibility and develop their social image by dealing with the problems of their elderly customers, who will always have special needs. Above and beyond these social policy concerns, banks stand to gain from increased usage of ACMs on the part if their elderly customers, who are after all a very large group.

In conclusion, we could say that more frequent usage of ACMs by elderly persons can be achieved by:

• Familiarizing the elderly with this technology by providing systematic and specific information geared to the needs of the respective target population, even by means of special education and training programs with a view to achieving the desired result,

• Adapting programs and machines to the special needs of this specific age group,

• Providing for easy and smooth access and, lastly, by

• Preserving their personal integrity, which would seem to be a primary concern within this particular age group.

Our study provides an initial approach to the problem at hand, and at the same time points to the need to explore the issue in more depth, by means of further research in this area on a national and international level.

3695

References

- Armagou, J.G., (1999). The Profitability of Private vs. State Owned Commercial Banks in Greece, RISEC, 46,n751‐778

- Archontakis Α., Kyriakopoulos Γ., (1997) The Information Technologies in the Greek Banking System, GreeknSociety of Computer Science and Information Technology Scientists, Athens (In Modern Greek)

- Brissimis, S. N., and Kosma, T. S., (2005). Market Power, Innovative Activity and Exchange Rate Pass‐Through.nApril 2005

- Βasiliou, D., (1993). Exploring the Profitability of the Greek Banking Market. Bull. Union Greek Banks 37/38 ,npp. 95‐98.

- Daniilidou, N., Zavras, D., Kyriopoulos, J., Georgoussi, E. (2003), Health and social care in aging population:nan integrated care institution for the elderly in Greece.Int J Integr Care. 22;3:e04

- Gortsou, Ch., (2001). General Overview of the Existing Control of Capital Sufficiency and the Recent Revisionnin 2001. Bulletin of the Union of Greek Banks. (In Modern Greek)

- Teperoglou A., (1980), Open Care for the Elderly in Greece. In Open Care for the elderly in Seven EuropeannCountries, Amman A (Ed). Pergamon Press, London

- Teperoglou, A., Kinia, E., Papakosta, M., Tzortzopoulou, M. (1990), Evaluation of the contribution of the openncare centers for the elderly. Athens (in Modern Greek).

- Thomadakis, S., (1995). Liberalisation of Markets and Reshuffling Within the Greek Banking System. PapazisinEditions. (In Modern Greek)

- Κaramouzis, Ν., (1996). Purchasing of Securities and Fixed Revenue Titles, National Bank of Greece, Athensn(In Modern Greek)

- Kozier B., Erb G., Oliveri R., (1991) Fundamentals of Nursing, Addison‐Wesley, Menlo Park, California

- Lazaretou, S., (2004). The Drachma, Foreign Creditors and the International Monetary System. Tales of anCurrency During the 19th and the Early 20th Century, August 2004.

- Noulas, A., (1999). Profitability and Efficiency of the Greek Banks (1993‐1998). Bull Union Greek Banks 4,npp. 53‐60.

- Noulas, A.G., (1997). Productivity Growth in the Hellenic Banking Industry: State Versus Private Bank.nApplied Financial Economics 7, pp. 223‐228.

- Mathoioudaki, S., (1995). Performance of Greek Banks. Commercial Bank of Greece, Economic Survey,nVolume 3 (in Modern Greek)

- Miller, S. M. and A. G. Noulas, (1996). The Technical Efficiency of Large Bank Production, Journal of Bankingnand Finance 20, 495‐509.

- OECD Health Data 2004, Comparative Analysis of 30 Countries, 3rd Edition.

- Provopoulos, G., Kapopoulos, P. (2003). The Strength of the Monetary and Economic System, KritikinPublications, Athens (In Modern Greek)

- Sapountzi, D., Dimitriadou Α, Minassidou Ε. Demographic Trends Of The Greek Population AndnConcequently Changes Of The Traditional Grek Family: A Challenge For An Expansion Of The Current NursingnRoles In Greece (1992) Proceedings 19ου Panhellenic Nursing Congress, Rhodes, GREECE

- Soteriou, A., and Zenios, S., (1999). Operations Quality and Profitability in the Provision of Banking Services.nManage Science 9, pp. 1221‐ 1238

- https://www.sfms.org/AM/Template.cfm?Section=Home&CONTENTID=1931&TEMPLATE=/CM/HTMLDisplay.cfm&SECTION=Article_Archives (Visited 2‐3‐2007)