Keywords

Super-shops; Fish market; Marketing cost; Stakeholders; Value chain

Introduction

In recent days, big metropolitan cities have been nurtured with affluent super shop chains like Agora, Nandan, Meena Bazar, Shawpna, etc. Raw, dressed or processed fish are being marketed by these convenient super shops at comparatively higher price, while quality of these products are not often ensured. In affluent city outlets, fish are supposed to be marketed through organized groups with minimum intermediaries. Still price has gone very high, but the primary producers/fish farmers get very minimum share of this high profit margin. Considering the high costs of aquaculture inputs, these profit margins should be reasonably distributed to the primary producers for sustainable development of aquaculture and steady supply of fish.

The study of value chains combination of two key concepts: value and chain. Value means “value added” in the Value Chain Analysis (VCA) as it characterizes the incremental value of a resultant product produced from processing of a product. Kaplinsky and Morris (2000) defines VCA as study of the “full range of activities which are required to bring a product or service from conception, through the different phases of production (involving a combination of physical transformation and the input of various producer services), delivery to final consumers, and final disposal after use”.

A great deal of works have been done on the marketing, supply and value chain of fish and fishery products in ordinary urban, peri-urban and rural markets, but supply and value-chain status of fish and fish products in affluent markets are completely unknown. Given the increased buying power of affluent consumers in cities, it is imperative to study the marketing structure, supply and value chain, along with the quality deficiencies of fishery items sold in super shops, in order to identify constraints, improve efficiency on distribution from farm to fork and ensure higher fish farm income. The initiative will help enhance economic growth through expansion of aquaculture as well as super shop business along the country.

Materials and Methods

Study area

Four affluent super-shops and 8 outlets (2 outlets for each) were selected for the present study. These were i). Agora- Rifle Square Center and Mirpur 1 Center (near Sony Cinema Hall); ii). Meena Bazar – Kazipara, Mirpur Center and Azimpur-Lalbagh Center; iii). Shawpna- Mirpur 6 (Proshika Moore) Center and Azimpur- Lalbagh Center and iv). Nandan - Mirpur Center and Dhanmondi center. The agents/brokers or farmers supplying fish to these super shops were identified by repeated field visits, personal contacts and interviews. The persons contacted were Windowin- Charge/ Manager of Super Shop, supply agents, paikers, fish traders, aratdars (auctioneers), fish farmers and fishermen of the landing and auction centers.

Rapport building, awareness raising, establishing linkage

Research team visited research areas to identify stakeholders, build rapport, raise awareness and select focal points - who would volunteer the functional linkage between project and marketing people, assist in data collection through a check-list and questionnaire interview and involving in the quality assessment of distributed fish.

Results and Discussion

The origin of fish in super shops

Fish are generally landed in road-side shore of natural watershed or farm house, spreading throughout the country (Nowsad, 2010). A landing center is the place where different types of fresh fish and fisheries commodities are accumulated from different harvesting sources like river, haor, beel, gher, pond, estuaries and sea. The harvested fish are transferred from the landing centers to the consumer markets via different channels (Ali et al. 2004). Fish landing centers play a vital role in quick and smooth disposal of fresh fish, as well as in retaining quality of fishery products. Fish are transferred to different parts of the country and also to the other countries through landing centers and some gateways. The number of landing centers is high in Dhaka division (Rahman, 2012). Dhaka is blessed with huge capture and culture fisheries (Table 1).

| Landing spot |

Agora |

Nandan |

Meena Bazar |

Shawpna |

| Riffle Sqr |

Mirpur-1 |

Mirpur |

Danmondi |

Kazipara |

Azimpur |

Mirpur-6 |

Lalbagh |

Kawran Bazar,

Zatrabari, Showarighat,

Rampura |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

| Gabtoli |

|

√ |

√ |

|

√ |

√ |

√ |

√ |

| Beri-Band (Mirpur) |

|

√ |

√ |

|

√ |

|

√ |

|

| Kaptan Bazar |

√ |

|

|

|

|

√ |

|

√ |

| Trishal |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

| Shambhuganj/Fulpur |

|

|

|

|

|

|

|

|

| Kulierchar, Chamraghat |

√ |

|

√ |

√ |

√ |

|

√ |

|

| Vairab |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

| Mohanganj |

√ |

√ |

|

|

|

|

|

|

| Nandail |

|

|

|

√ |

√ |

|

|

|

| Daudkandi |

√ |

√ |

|

|

|

|

|

|

| Chandpur |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

| Barguna |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

| Barobazar, Jessore |

√ |

√ |

√ |

|

√ |

|

√ |

√ |

| Satkhira |

√ |

√ |

|

|

|

√ |

√ |

√ |

| Shingra |

|

√ |

√ |

√ |

√ |

|

√ |

|

| Shunamganj |

√ |

√ |

√ |

|

√ |

|

√ |

|

| Moulvibazar |

√ |

|

|

|

|

|

|

√ |

| Firingi Bazar Ghat |

√ |

√ |

|

√ |

√ |

√ |

√ |

√ |

| Cox’s Bazar |

√ |

√ |

√ |

√ |

√ |

|

√ |

√ |

Table 1: The origin of fish selling in super shops.

Actors in the super shop supply chain

Study revealed that fish caught and/or produced in peripheral districts are purchased through local agents by the traders, mostly wholesalers or aratdars, who then transferred them either directly or agents to the super shops. In the present study, 3 types of supply chains were noticed in selling fish through super shops. These are:

Type 1: Fisherman/producer-wholesaler-aratdar-super shopconsume.

Type 2: Fisherman/producer-aratdar-wholesaler-aratdarsuper shop-consumer.

| Fish Group |

Percent Composition in Super Shops |

Average % |

| Agora |

Meena Bazar |

Nandon |

Shopno |

| Indian Major Carps |

35 ± 2 |

40 ± 4 |

40 ± 5 |

35 ± 2 |

37.5 ± |

| Other Carps |

5 ± 0.3 |

2 ± 0 |

- |

5 ± 0.1 |

3 ± |

| Exotic Carps |

30 ± 1.5 |

30 ± 3 |

38 ± 4 |

40 ± 6 |

34.5 ± |

| Cat fish |

12 ± 1 |

13 ± 1 |

10 ± 3 |

5 ± 1 |

10 ± |

| Spiny Eel |

4 ± 0.3 |

5 ± 1 |

- |

2 ± 0 |

2.75 ± |

| Feather back |

1 ± 0 |

- |

- |

1 ± 0 |

0.5 ± |

| Gobies |

1 ± 0 |

- |

- |

- |

0.25 ± |

| Snake head |

5 ± 0 |

5 ± 0.4 |

5 ± .2 |

6 ± 2 |

5.25 ± |

| SIS |

2 ± 0.1 |

2 ± 0.1 |

- |

2 ± 0 |

1.5 ± |

| Ilish |

2 ± 0 |

1 ± 0 |

2 ± 0.1 |

2 ± 0 |

1.75 ± |

| Prawn/ Shrimp |

3 ± 0.2 |

2 ± 0 |

5 ± 0 |

2 ± 0 |

3 ± |

Table 2: Major groups of fishes sold in super shops in Dhaka.

Type 3: Fisherman/producer-bepari/paid agent-super shopconsumer.

| Fish |

Agora |

Meena Bazar |

Shawpna |

Kawran Bazar |

| Price |

% Increased |

Price |

% Increased |

Price |

% Increased |

| Rui |

310 ± 11 |

24.0% |

315 ± 25 |

26.0% |

300 ± 15 |

20.0% |

250 ± 6 |

| Catla |

330 ± 13 |

26.9% |

320 ± 7 |

23.1% |

320 ± 13 |

23.1% |

260 ± 7 |

| Mrigel |

350 ± 14 |

34.6% |

350 ± 22 |

34.6% |

350 ± 15 |

34.6% |

260 ± 10 |

| Boal |

500 ± 21 |

42.9% |

510 ± 21 |

45.7% |

480 ± 15 |

37.2% |

350 ± 10 |

| Tilapia |

120 ± 5 |

20.0% |

130 ± 10 |

30.0% |

120 ± 10 |

20.0% |

100 ± 5 |

| Pangas |

120 ± 3 |

20.0% |

125 ± 5 |

25.0% |

110 ± 7 |

10.0% |

100 ± 3 |

| Carpio |

140 ± 7 |

27.8% |

135 ± 3 |

18.5% |

130 ± 5 |

18.2% |

110 ± 5 |

| Bata |

160 ± 7 |

45.5% |

150 ± 8 |

36.3% |

150 ± 5 |

36.4% |

110 ± 6 |

| Shing |

420 ± 18 |

20.0% |

450 ± 14 |

20.0% |

400 ± 25 |

14.3% |

350 ± 15 |

| Magur |

400 ± 15 |

33.3% |

400 ± 22 |

33.3% |

390 ± 28 |

30.0% |

300 ± 12 |

| Shrimp |

550 ± 21 |

22.2% |

500 ± 25 |

11.1% |

550 ± 23 |

22.2% |

450 ± 20 |

| SIS |

500 ± 17 |

25.0% |

- |

- |

490 ± 7 |

22.5% |

400 ± 24 |

| Mola |

400 ± 14 |

14.3% |

400 ± 10 |

14.3% |

400 ± 8 |

14.3% |

350 ± 34 |

| Batashi |

500 ± 18 |

28.2% |

490 ± 22 |

25.6% |

480 ± 12 |

23.1% |

390 ± 22 |

| Cihtal |

450 ± 20 |

12.5% |

460 ± 18 |

15.0% |

445 ± 22 |

11.3% |

400 ± 8 |

| Ilish |

700 ± 25 |

16.7% |

680 ± 15 |

13.3% |

700 ± 24 |

16.7% |

600 ± 30 |

| Rupchada |

800 ± 28 |

14.3% |

- |

- |

- |

- |

700 ± 38 |

| Vetki |

430 ± 20 |

22.9% |

- |

- |

- |

- |

350 ± 8 |

| Koral |

440 ± 20 |

15.8% |

450 ± 14 |

18.4% |

440 ± 12 |

15.8% |

380 ± 14 |

| Average (%) |

|

24.57 |

|

24.38 |

|

21.74 |

|

Table 3: Price variation (average value) of fish in super shops and general retail fish market (Tk/Kg).

Fish sold in Dhaka city super shops

A great variety of fishes were found to be sold in four super shops of Dhaka Metropolitan city. The composition of major fish groups handled are presented in Table 2.

Price of fish in super shops

Prices were found to vary based on species, size, demand/ consumers’ preference, source/origin (distance travelled), seasonality/availability and freshness quality. Generally, the prices of fish in super shop outlets were fixed in the morning before display, based on the day’s purchase price. Average prices of market size fish for some selected species for a whole month were observed, as have been shown in Table 3. The consumer prices in the super shops were compared to the average general retail fish market prices of more or less same sized fishes in the same month. The general retail fish markets considered were Kawran Bazar DIT Market and MohammadpurKrishi Market. A simple comparison was given here to understand the trend of price variation.

Price sharing of fish

The sharing of fish prices among the stakeholders at different steps of value chain has been given in Table 4. Live Indian major carps (rui, catla, mrigal and kalibaush) of 1.0 to 1.7 kg size with a fisherman price of about Tk.170 were sold at super shop out-lets @ Tk.400/kg. Here the fishermen’s share on consumer payment (FSoCP) was only 42.4%, while the intermediaries share on consumer payment (ISoCP) was 57.5%. Similar phenomenon was also observed in prawn and shrimp where FSoCP and ISoCP were 56 and 44 % respectively. On the other hand, for most of the fishes like catfishes, spiny eel (baim), feather-back (chitol, foli), gobbies (bele), snakeheads (shol/gojar, small fishes and huge other species, the FSoCP ranged from 65-70% and ISoCP ranged between 30 and 35%. The average FSoCP and ISoCP were recorded to be 62.27 and 30.27 % respectively (Table 4).

| Fish Group |

Local name |

Scientific name |

Weight (Kg) |

Price at fisher

(Tk/Kg) |

Super shop price (Tk/Kg) |

FSoCP

(%) |

ISoCP

(%) |

| Indian Major Carp |

Rui |

Labeorohita |

1.7 |

169.6 |

400.0 |

42.4 |

57.5 |

| Catla |

Catlacatla |

1.7 |

| Mrigel |

Cirrhinuscirrhous |

1.2 |

| Calbasu |

Labeocalbasu |

1.0 |

| Other Carps |

Bata |

Labeobata |

0.2 |

96 |

158.4 |

60.61 |

39.39 |

| Bighead carp |

Aristicthysnobilis |

1.0 |

| Exotic Fish |

Silver carp |

Hypophthalmicthysmolitrix |

1.2 |

88 |

160 |

55 |

45 |

| Grass carp |

Ctenopharyngodonidella |

0.9 |

| Common carp |

Cyprinuscarpiovarcommunis |

0.8 |

| Pangus |

Pangasiussutchi |

1.2 |

| Nilotica |

Oreochromisnilotica |

0.25 |

| Tilapia |

Tilapia mossambicus |

0.25 |

| Sharputi |

Barbonymusgonionotus |

0.2 |

| Cat fish |

Shing |

Heteropneustesfossilis |

0.1 |

392 |

560 |

70 |

30 |

| Magur |

Clariusbatrachus |

0.2 |

| Tengra |

Mystustengana |

0.04 |

| Golsha |

M. vitatus |

0.04 |

| Golsha |

M. cavasus |

0.03 |

| Ayr |

Sperataaor |

0.9 |

| Boal |

Wallagoattu |

1.2 |

| Spiny Eel |

Tara baim |

Macrognathusaculeatus |

0.15 |

240.0 |

356 |

67.7 |

32.58 |

| ShalBaim |

Mastacembelusarmatus |

0.2 |

| Feather back |

Chital |

Notopteruschitala |

2 |

336 |

500 |

67.2 |

32.38 |

| Foli |

NotopterusNotopterus |

0.15 |

| Gobbies |

Baila |

Glosogobiusgiuris |

0.05 |

180 |

280 |

64.29 |

35.71 |

| Snake head |

Taki |

Channa punctate |

1.2 |

232 |

350 |

66.39 |

33.71 |

| Shol |

Channastariata |

| Gozar |

Channamaruliuas |

| Prawn |

Bagda |

Penaeusmonodon |

0.08 |

280 |

500 |

56 |

44 |

| Golda |

Macrobrachiumrossenbergii |

|

| SIS |

Mola |

Amblypharyngodonmola |

0.02 |

248 |

360 |

68.89 |

31.11 |

| Puti |

Puntius sp. |

0.02 |

| Marine |

Rupchada |

StromateusChinensis |

0.5 |

800 |

1300 |

61.53 |

38.46 |

| Coral |

Podysis hasta |

0.3 |

| |

Ilish |

Tenualosailish |

0.8 |

500 |

760 |

65.79 |

34.21 |

| Average value |

62.27 |

30.27 |

Table 4: Price sharing of fish among the market actors. FSoCP=Fishermen’s share on consumer payment; ISoCP=Intermediaries’ share on consumer payment.

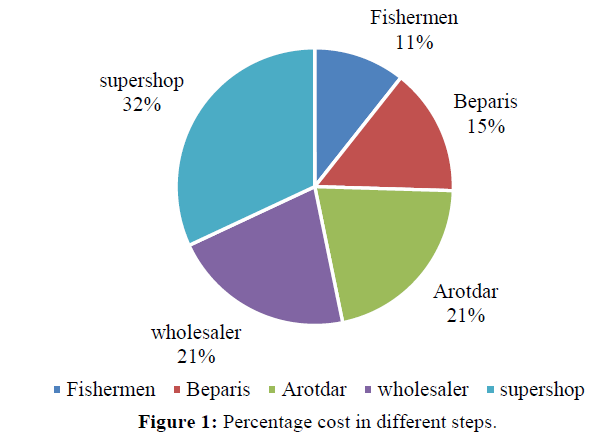

Marketing cost and marketing margin

Marketing cost and marketing margin are usually used to estimate profitability of different intermediaries (Figure 1). Nine types of major marketing costs were observed to be involved in the value chain while marketing fish through super shop (Table 5). It was observed that marketing cost varied from Tk. 5.0/kg to Tk. 15.0/kg fish transported, where farmers incurred the lowest and super shops spent the highest. The aratdars and wholesalers/ suppliers spent an equal amount of Tk. 10/kg for marketing of fish. Some of the aratdars acted as wholesalers or even pikers, as to collect fish from the farmers and then to sell to the retail outlets. So they incurred lower cost for transport. Out of such marketing costs, highest cost incurred was for transport, about 22% to 42%, where wholesalers spend the highest and super shop spend the lowest. Second highest marketing costs incurred were container/ ice box, followed by costs for ice, water, electricity, rent for store/cold storage, etc. About 5-8% costs were spent for paying municipal taxes and some undue tolls. Business management often incur higher costs.

| Type of costs |

Fishermen/

Producer |

Local

collectors |

Aratdar |

Wholesaler/ supplier |

Super shop |

| Transport |

40% |

41% |

31% |

42% |

22% |

| Wage for loading /unloading |

- |

- |

7% |

10% |

5% |

| Container/ice box |

20% |

41% |

15% |

4% |

17% |

| Ice/water |

- |

13% |

8% |

11% |

11% |

| Tax/toll |

- |

5% |

8% |

- |

6% |

| Electricity |

- |

- |

8% |

11% |

11% |

Rent for store/

godown/cold-storage/space |

- |

5% |

8% |

11% |

11% |

| Wastage/wet reduction |

- |

- |

- |

- |

6% |

Others (shop

management/DA, etc.) |

40% |

- |

15% |

11% |

11% |

| Total cost in TK |

5/Kg |

6.96/Kg |

10/Kg |

10/Kg |

15/Kg |

Table 5: The marketing costs in each steps of distribution channel.

Figure 1: Percentage cost in different steps

However, the marketing cost of fish sold through super shops was higher than that found by Rahman et al. (2009) in Khulna (20-25%) and by Alam et al. (2010) in Showarighat of Dhaka (15-20%). These variations could be attributed to different types of costs incurred in different areas, based on availability of inputs and services.

Conclusion

Affluent super shop chain outlets in Dhaka city, equipped with good display and preservation facilities, sell better quality wet fish compared to those sold through general fish markets, at a rate of 20-25% higher price. Both marketing margin and marketing profit were higher in super shops compared to other stakes in the distribution path, owing to high management costs of retail sell in the super shops. Various constraints were identified and possible solution options were discussed, the most important one is adding value to fish by presenting various product forms, to strengthen the market so that the marketing margins of other stakes can be improved. The traders, agents or brokers and contract farmers supplying fish to these super shops were identified by field visits, personal contacts and interviews. It was observed that a significant portion of the fishes were supplied from different wholesale fish markets of Dhaka metropolitan city and fish production zones of adjacent districts. Various stakeholders are involved in fish value chain concerning super shop outlets. Indian major carps viz, rui, catla and mrigel were the most dominant species, followed by exotic carps (carpio, silver carp or bighead carp, Thai sarpunti, etc), catfishes (pangas, aair, boal, golsha, etc) and snakeheads (shol and taki). The variation in species and types were more in some outlets compared to others. Major marketing costs of the fish traders in the supply chain identified were transport cost, wage for loading/unloading, container/ice box, ice and water, tax and toll, electricity, rent for space/godown/cold-storage and weight reduction. On the other hand, for most of the fishes, the average FSoCP and ISoCP were calculated to be 62.27 and 30.27 %, respectively.

17799

References

- Alam, M.J., Yasmin, R., Rahman, A., Nahar, N., Pinky, N.I et al. (2010) A study on fish marketing system in Swarighat, Dhaka, Bangladesh. Nat and Sci8, 96-103.

- Ali, M.Y., Salim, G.M., Mannan, M.A., Rahman, M.M., Sabbir, W et al. (2004) Fish species availability observed in the fish landing centers of Khulna District in Bangladesh. J. Biol. Sci4, 575-580.

- Kaplinsky, R., Morris, M. (2000) A Handbook for Value Chain Research. Ottawa: International Development Research Center (IDRC) p: 109. Nowsad, A.K.M.A. (2010) Post-harvest loss reduction in fisheries in Bangladesh: A way forward to food security: FAO-BD, NFPCSP - PR # 5 Project, FAO, Dhaka.

- Rahman, M. (2012) Landing and distribution of fish in South-western, middle and North-western regions of Bangladesh. MS Thesis, June, 2012. Department of Fisheries Technology Bangladesh Agricultural University p: 94.

- Rahman, M.M.,Hossain, M.M., Rahman, S.M.,Alam, M.H. (2009) Fish marketing system in Khulna, Bangladesh, J. Innov. Dev. Strateg3, 27-31.