Keywords

Biosimilars; R&D capacity; Patent; Life science

Introduction

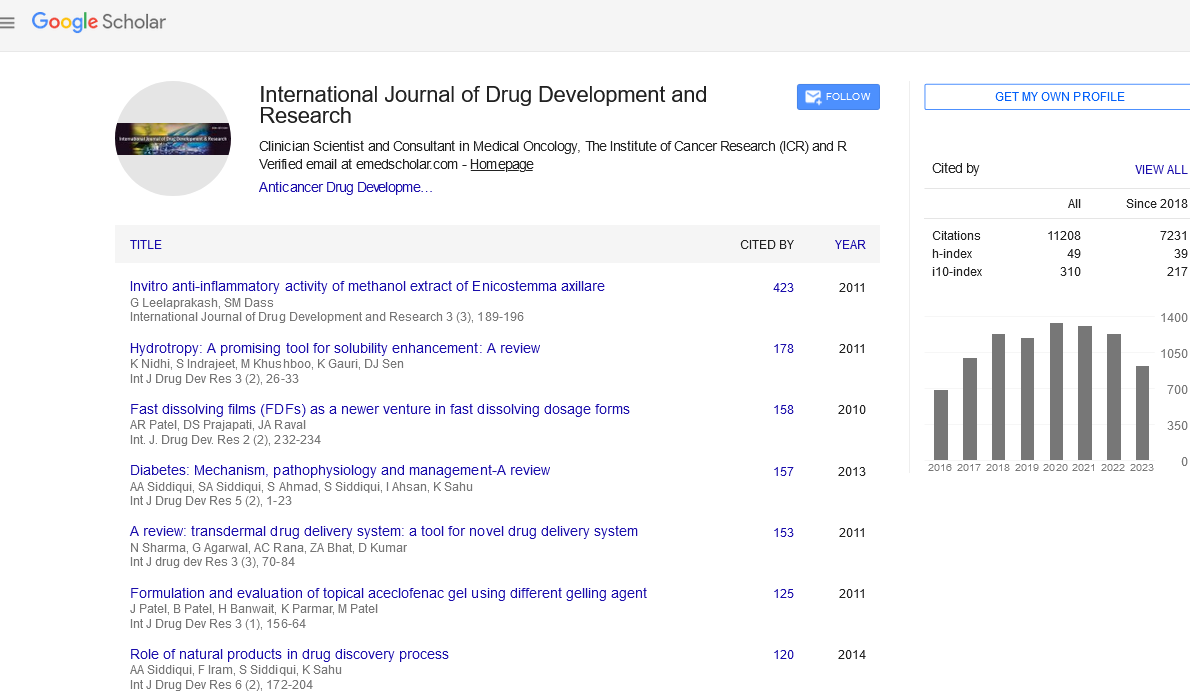

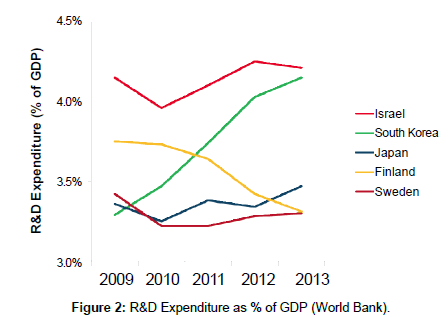

As a member of the Organization for Economic Cooperation and Development (OECD) and G20 major economies, and one of the foremost “Asian Tiger” nations, South Korea has established itself as a leading economic power. The country recorded a GDP of $1.4 trillion in 2014, making it the thirteenth largest economy in the world [1]. GDP per capita was $28,000 in 2014, or roughly equivalent to that of Spain ($30,000), Japan ($36,000), and Italy ($35,000) [2]. In addition, South Korea also ranks near the top among the world on other development indicators such as healthcare, education, and R&D expenditure. South Korean life expectancy is now higher than the OECD average (81) [3] and 42% of the population aged 25-64 attains tertiary education, which is higher than the OECD average of 32% (Figure 1) [4].

Figure 1: Percent of Population (Ages 25-34) with Tertiary Education (OECD).

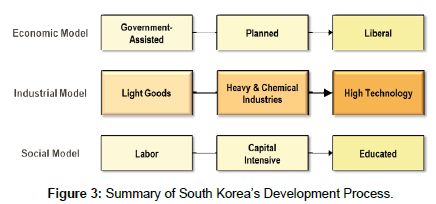

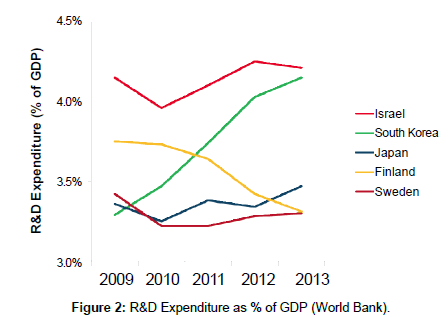

According to the Bloomberg Global Innovation Index, South Korea ranks first overall as the most innovative country in 2015 when considering a variety of metrics such as R&D capacity and productivity, as well as patent activity. South Korea (along with Israel) ranks first in terms of annual R&D spending (the World Bank estimates that Korea spends over 4% of its GDP on R&D) (Figure 2) [5]..

Figure 2: Percent of Population (Ages 25-34) with Tertiary Education (OECD).

Samsung alone spent a total of $14 billion in 2014 [6], and in a 2015 ranking of the most innovative companies in the world by Boston Consulting Group the company placed fifth, only behind Apple, Google, Tesla Motors, and Microsoft [7].

The above is remarkable, as South Korea was until very recently one of the poorest countries in the world, left devastated in the aftermath of the Korean War (1950-1953). In 1960, South Korea had a per capita income barely reaching $80 in current prices [8] and life expectancy was 16 years less than the OECD average [3]. However, South Korea underwent a tremendous and rapid economic transformation starting in the 1960s, which set the foundation for its aggressive growth into the heavy and chemical industries, high-technology, and more recently, the biopharmaceutical industry.

The goal of this paper is to provide a brief overview of South Korea’s economic development success with a particular focus on its more recent investment and focus on the global biopharmaceutical industry:

1. Overview of South Korea’s general economic development and transition, from the 1960s through present day.

2. Development of South Korea’s successful high technology sector.

3. Growth of South Korea’s biopharmaceutical sector.

4. Role of South Korean life science companies in the global marketplace.

5. Ongoing challenges and expectations of the South Korean biopharma industry for the future.

Overview of South Korea’s Economic Development Process

After the Korean War, South Korea began to make a slow recovery, as supported by assistance from the United States. Heavy emphasis was placed on import substitution in the light industries-such as food and textiles-as well as education. This led to the rapid creation of a highly educated and skilled, growing, and yet low-wage work force [9].

The establishment of the Park regime following the military coup of May 1961 ushered in a period of aggressive, government-led economic development. With the institution of the first of a series of “Five-year Plans,” the Park regime focused its growth strategy on increasing exports [10]. The goal of this period was to develop the infrastructure necessary to support integration into the global economy and the accumulation of foreign capital. Growth during this time was characterized by significant government investment (including the setting of informal export targets for various industries) as well as a close working relationship between the government and businesses, which would continue well into the 1980s [11]. It is notable that beginning as early as 1961, while still in the early phase of industrialization, the government began to plan for long term growth. The Ministry of Science and Technology (MOST), as well as a dedicated group of R&D facilities under the Korea Institute of Science and Technology (KIST) were established to foster comprehensive science and technology research, and lay the groundwork for later economic transitions [12].

As the country began to find its footing, the focus on the exports of light goods shifted in the 1970s to the development of heavy and chemical industries such as steel, heavy machinery, and shipbuilding [13]. During this period, the government began to strategically sponsor key companies with high income and growth potential. As a result, the 1970s saw the rapid growth of a small number of government supported “chaebols” – large business conglomerates [14]. By 1977, it is estimated that a vast majority of all commodities were produced under near oligopoly conditions – the top three manufacturers of each industry held more than 60% of market share, and 48% of South Korea’s GNP in 1980 was attributed to the ten largest chaebols [8]. As a result of this tightly managed export-oriented growth strategy, the sponsorship of scale, and an ability to invest for the long term, commodity exports increased from 7% of GNP in 1967 to 33% of GNP by 1977 [11].

Despite the successes seen in the 1970s with the promotion of heavy industry manufacturing and exports, South Korea eventually reached a point where it was becoming increasingly difficult to compete on a global stage. Domestic companies were reliant on technology imported from abroad to support the growth of their heavy goods [9], and the heavy and chemical industries were capital-intensive [11]. Confident in the stability of the economic base built through the 1970s, the 1980s saw a shift towards liberalization [15] and open markets [8]. From an investment perspective, South Korea began transitioning from the heavy and chemical industries to the technology sector, placing a greater emphasis on research and innovation.

Development and Growth of the High Technology Sector

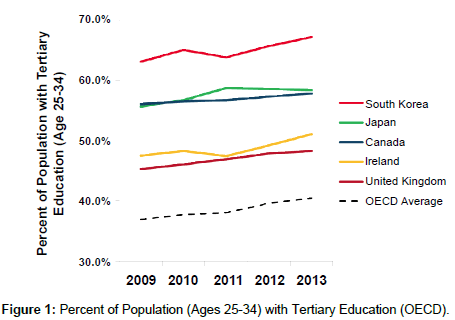

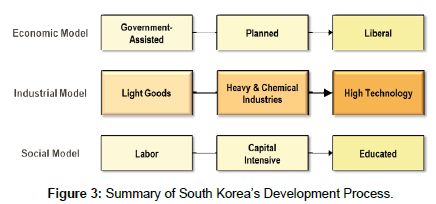

As with both the first light goods and second heavy industry economic transitions, the technology boom was initially driven by government investment and the establishment of research institutes and universities. The capital accumulation and continued investment in education laid the necessary groundwork for the nation’s successful penetration into high technology (Figure 3). The country has been rightly touted as a model of successful economic transition, moving from strength to strength in rapid succession.

Figure 3: Summary of South Korea’s Development Process.

As noted earlier in the paper, a critical foundation for South Korea’s aggressive push into the high technology sector was the financial, legal, and regulatory infrastructure that it had established throughout its earlier phases of economic development. Furthermore, chaebols led private sector efforts as they were already equipped with the reach, resources, and infrastructure to support the high risk and capital intensive projects necessary to compete in the global markets [9,14].

South Korea’s strategy to penetrate the high technology market was initially grounded in the idea of simply out-manufacturing its major global competitors. Examples include:

1. The production of DRAM chips has dramatically increased (led by Samsung). In 1984, Samsung’s share of the global memory chip market was near zero. Today, South Korean companies hold the majority share of the global DRAM market [16]. From July to September 2015, Samsung Electronics Co. and SK Hynix Inc. held an impressive 47% and 28% of the global DRAM market, a combined 75% of the total market [17]. Key to this growth and competitiveness was South Korea’s established manufacturing efficiency for high yield, high quality, rapid turnover, and “incremental process innovation” [16].

2. OLED display technology was mastered in South Korea. While Sony was the first company to develop a next-generation organic light emitting diode (OLED) technology television in the late 2000s, they found it difficult to mass-produce the displays cost effectively. In response, Samsung and LG Electronics began manufacturing smaller OLED displays and quickly built up their manufacturing capacity to support larger displays to fit televisions. They accomplished the high quality mass-production techniques (and cost structure) needed to secure the market [18].

3. A leader in telecom innovation. South Korea became the first country to launch CDMA 2000 service (an early version of 3G technology) in 2001. This led to US companies such as Motorola establishing R&D facilities in South Korea to learn from and leverage the technology and mobile services [19]. South Korea currently boasts the highest broadband penetration at 97%, along with the fastest broadband speed [20]. It has been reported in 2014 that South Korea is investing over $1 billion in 5G services, which are estimated to be 1,000 times faster than 4G connectivity [21].

4. South Korean automotive exports have expanded over the last decade. In the early 2000s, South Korea exported a limited number of intermediate automotive goods or finished vehicles. By 2014, South Korea was ranked fifth in the world in unit production and export volume of automobiles, succeeded only by China, the USA, Japan, and Germany. Other than Japan, it is currently the only Asian country with an established presence in the United States [22]. To drive this worldwide expansion, South Korea harmonized almost 40 vehicle safety standards with UN and GTR regulations, as well as upheld California emission regulations for vehicles exported to the US [23]. As of 2013, South Korean automotive companies, such as Hyundai and Kia, exported 68.3% of their total production, with the largest volume going to the US [23]. Furthermore, next generation technologies associated with hybrid and fuel-cell vehicles are expected to expand within the next five years [23].

In summary, the high technology development and globalization efforts that began in the 1980s allowed South Korea to become a significant player in the global economy today. In 1988, high technology products only comprised 16% of total exports. However, that figure had more than doubled to 35% in 2000 [24]. The country is now one of the largest exporters of high technology in the world (~$130 billion) and this number continues to grow quickly (nearly matching the United States total of ~$150 billion) [25].

Growth of South Korea’s Biopharmaceutical Industry

South Korea has begun to turn its attention to biopharmaceuticals, targeting this sector as another opportunity to profitably leverage the country’s increasing R&D and innovation capacity and capabilities.

Similar to prior industrial expansion efforts, the government promoted research and innovation in the biotech space through academic support and direct investment in manufacturing capacity and development efforts. In the mid-1980s, the government established the Korea Research Institute of Bioscience and Biotechnology (KRIBB) [26], a research institute located in Daejeon dedicated to biotech research, new drug discovery, and drug development [27]. In 1994, the government launched the first national initiative to grow the industry-the “Biotech 2000” plan-which aimed to bring the South Korean biopharma industry to the same level as the leading biotech industries of other industrialized nations by 2007 [28]. The program involved investing roughly $20 billion for various biotech-related research initiatives from 1994 to 2007 [29]. This effort was then followed by the second government-supported plan dubbed “Bio- Vision 2016,” a ten-year initiative with the goal of making South Korea one of the leading hubs of the biotech industry by 2016 [30]. These investments contributed to a significant jump in scientific productivity (e.g., the number of biotech-related publications by South Korean scientists increased by nearly a factor of ten from 1992 to 2002, with approximately 350 publications recorded in 2002) [28].

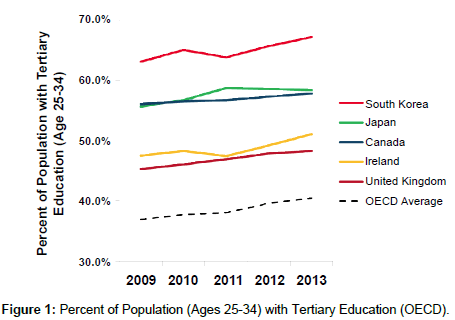

Driven by both sponsored research initiatives, as well as by the pressure to meet the healthcare needs and demands of an increasingly mature population, the South Korean biopharma industry has grown rapidly in the last two decades. In 2000, only one Biopharma Company was publically listed on the Korean stock market (KOSDAQ). By 2002 that number had increased to 23, [28] and as of 2012 there were 50 publically traded biopharma companies [31]. The landscape of South Korean biopharma has also changed significantly in the past few decades. While chaebols have dominated-and continue to dominatemost industries, including the biopharma industry, there has been a growth in new companies including various small and medium-sized firms (Figure 4) [28].

Figure 4: South Korean Biopharma Companies Ranked by 2012 Revenue ($M).

Role of South Korean Life Science Companies in the Global Marketplace

As the South Korean biotech industry continues to grow, it has placed significant emphasis on improving its biopharma manufacturing and clinical standards. This in turn has resulted in a rise in foreign investment and an increase in local collaboration activity. South Korean life science companies are rapidly shifting from mainly manufacturing generics, to toll manufacturing of biologics for global firms, to discovering and developing more complex new chemical entities, biologics, and engineered biosimilars.

Starting in the mid-1990s, South Korea made significant efforts to align with international standards. Good Manufacturing Practice (GMP) became mandatory in 1995 [32] and South Korean companies invested roughly $1.4 billion (between 2007 and 2008) in order to make process changes and improvements to prepare for compliance with the current Good Manufacturing Practice (cGMP) standards introduced in 2010 [33]. Now, most manufacturing plants in South Korea are cGMP compliant and routinely authorized by major regulatory bodies such as the FDA and EMA [32]. This regulatory harmonization has opened up global partnership opportunities. As an example, the South Korean company Celltrion was approved by the FDA in 2007 to manufacture the monoclonal antibody Orencia (abatacept) for distribution by Bristol-Myers Squibb (BMS) globally in the treatment of rheumatoid arthritis [34]. In addition, BMS entered into a ten-year agreement in July 2013 with Samsung BioLogics to manufacture the monoclonal antibody Yervoy (ipilimumab) for the treatment of certain cancers [35]. The agreement was further expanded in April 2014 to include additional BMS drug candidates [36].

In addition to vastly improving manufacturing processes to align with international standards, South Korea also invested in improving the quality and credibility of its clinical trial programs. The country introduced Good Clinical Practice (GCP) legislation in 1995 and in 2001 South Korea adopted the updated International Conference on Harmonization GCP standards (ICH-GCP) [32,37]. This regulatory investment opened the door to multi-national trials. In 2007 alone, there were over 450 authorized clinical trial sites in South Korea [38] with approximately 280 trials approved by the Korean FDA (KFDA). By 2010, that number had grown to 676 clinical trials which puts South Korea at seventh in the world in terms of clinical trial volume, ahead of Spain, China, and Japan [32]. Perhaps most impressively, 69% of multinational trials now include a site in South Korea [32].

Along with global harmonization and integration, the past few decades have also marked the growth of home-grown innovation, which has in turn attracted more external investment. In 1999, Sunpla-a third generation anti-cancer agent following Cisplatin and Carboplatin-became the first domestically developed new drug approved by the KFDA [39]. Since then, more than twenty novel drugs have come to market [40]. Pfizer, AstraZeneca, Bristol-Myers Squibb, Sanofi, Novartis, and Otsuka have all invested heavily in local research and development [32,41-43].

In a natural next step for an industry with a history of developing generic and incrementally modified products, as well as contract manufacturing biologics at scale, South Korea more recently turned its sights on the massive global biosimilars market. In 2009, South Korea released its biosimilar guidelines [32] in order to create a domestic market, and several of its domestic companies invested in becoming global leaders. As a result, the past decade has witnessed the formation of several key collaborations between South Korean companies and multi-national biopharma firms. Two of the South Korean companies that are leading this race are Celltrion and Samsung Bioepis.

Case Study #1 - Celltrion

Celltrion was founded in 2002 [44], and is currently one of the early leaders in the global biosimilars race. The group was originally formed as a joint venture between VaxGen, a US company focused on the development of vaccines [45], and several Korean investors [46]. However, the company rapidly shifted its strategy and became a biologic contract manufacturer (the company has been serving as an FDA approved contract manufacturer for Bristol-Myers Squibb’s Orencia since 2007), and within the space of 10 years, Celltrion became the largest cell-culture manufacturing firm in the Asia-Pacific region (boasting an enormous 140,000 liter cGMP compliant bioreactor capacity by 2012).

In 2009, Celltrion formed a key alliance with Hospira (which has since merged with Pfizer). Under this distribution arrangement, Celltrion and Hospira agreed to market and distribute eight biosimilars in Celltrion’s pipeline across various geographies including North America and Europe (in many geographies where Celltrion has also contracted with local distributors that have a strong hospital presence) [47]. The alliance expanded Hospira’s biosimilars portfolio, adding five to its pipeline, and gave Celltrion access to the large distribution network that Hospira has established for its generic injectables business. This effectively provided Celltrion with commercial capabilities in important markets.

In 2012, Celltrion successfully became the world’s first company to launch a biosimilar monoclonal antibody, when its version of infliximab (Remsima) was approved by the Korean FDA [48]. The Korean launch was followed by launches in various markets across Latin America, Asia-Pacific, and Europe (including twelve European markets, including the United Kingdom, France, Germany, Italy, and Spain) [49]. The product is now sold in over 40 countries, and in some of the more centrally managed European markets (e.g., Norway), Remsima has already picked up fairly significant market share. The company has since filed for approval in the US, and following a positive recommendation by the FDA Arthritis Advisory Committee by a vote of 21-3 on February 10, 2016 [50], the FDA formally announced its approval of biosimilar infliximab (to be branded as Inflectra) for rheumatoid arthritis, ankylosing spondylitis, psoriatic arthritis, plaque psoriasis, Crohn’s disease, and ulcerative colitis on April 5, 2016 [51]. Inflectra is only the second biosimilar, and the first monoclonal antibody biosimilar, to be approved by the US FDA.

Pfizer’s acquisition of Hospira in September 2015 [52] changed the nature of the initial Celltrion distribution agreement- Pfizer returned the rights to biosimilar rituximab and trastuzumab which were duplicative with its own pipeline [53]. However Pfizer will continue to co-promote biosimilar infliximab while it divests its own biosimilar infliximab candidate [54]. Despite the recent changes, Celltrion is pushing ahead with its next planned global biosimilar launch and continues to strengthen its development pipeline which now includes biosimilar oncology candidates such as cetuximab and bevacizumab [55,56].

Case Study #2 - Samsung Bioepis

Samsung leveraged its general scale manufacturing and technology R&D expertise to quickly enter the biologics manufacturing and biosimilar markets. This began with the construction of a 30,000 liter production facility [57] and the formation of manufacturing relationships with multinational biopharma companies (e.g., BMS and Roche) [58].

Samsung announced its formal entrance into the biosimilars race when it entered a $300 million agreement with Biogen in 2011 to establish Samsung Bioepis, a joint venture focused on the development, manufacturing, and commercialization of biosimilars [59]. In 2013, Samsung Bioepis further partnered with Merck to develop and commercialize several biosimilar candidates. Samsung Bioepis is responsible for clinical development and regulatory approvals, while Merck and Biogen split commercialization responsibilities by geography [60,69].

In 2015, Samsung Bioepis saw its first two regulatory approvals in South Korea-biosimilar etanercept (fusion protein, for the treatment of rheumatoid arthritis-known as SB4) was approved in September 2015 [61] and its own version of biosimilar infliximab (SB2) was approved in December 2015 [62]. With the backing of its commercialization partners Merck and Biogen, Samsung Bioepis is also quickly looking to expand its biosimilars business globally. In November 2015, its biosimilar etanercept received a positive opinion from the EMA’s Committee for Medicinal Products for Human Use (CHMP) [63], and in January 2016 the product became the second biosimilar monoclonal antibody to win EMA approval in Europe. In addition, in May 2016 Samsung Bioepis received EU marketing authorization for infliximab (to be branded as FLIXABI), its second anti-TNF biosimilar [64]. Samsung Bioepis also has several other biosimilar candidates in its pipeline including biosimilar trastuzumab (for the treatment of cancer - SB3) and adalimumab (for the treatment of rheumatoid arthritis - SB5). These are both currently in the final phases of human testing (phase III development) [65].

In order to support the company’s rapid growth, Samsung announced in 2015 that it plans to build two more biologics manufacturing plants, at a cost of roughly $1.5 billion, which would make it one of the largest biologics manufacturers worldwide [58]. Further, Samsung Biologics Co Ltd, the contract manufacturer of biotech drugs which owns 91% of Samsung Bioepis, plans an IPO in 2016 to fund expansion of production capacity.

Standing of South Korea’s Biopharmaceutical Industry in the Global Marketplace Today

According to a 2014 IMS report, South Korea’s biopharmaceutical industry is currently ranked fifteenth in the world, and is categorized as developed (vs. emerging) along with the United States, the EU5 nations, Japan, and Canada [67]. While it is not as mature as its nearest neighbor Japan, the growth trajectory looks remarkably similar.

Like South Korea, Japan built the foundation of its biopharma industry on manufacturing-based growth with its emphasis shifting to research and innovation starting in the 1970s. Similar to the more recent South Korean example, the Japanese market underwent tremendous growth in the 1990s as a result of increased academic entrepreneurship and innovation, as well as an aggressive focus on globalization-both in terms of increased foreign investment in Japan, and the expansion of domestic companies abroad. From 1995 to 2005, the number of biopharma companies in Japan increased to over 500 and the number of Japanese companies expanding abroad grew to 284 [68]. Although South Korea’s biopharma industry began its growth phase roughly 20 years later, Japan’s success in the global marketplace shows the potential trajectory that South Korea may be able to achieve if it continues to invest heavily in innovation and globalization efforts.

Ongoing Challenges and Expectations for the Future

In summary, the South Korean economic miracle has extended from light goods, to heavy industry, to high tech, and now to biotech. Along the way, the country has built a thoroughly modern legal and regulatory framework, an arguably world class educational infrastructure, and an unusually productive level of public-private partnership activity. The people of the nation now enjoy first class healthcare benefits, and have significant life expectancy and low morbidity as evidence of their success. By most standards the country’s economic development is a model of what the transition of a nation from “developing” to “developed” should look like. It now has more in common with its Pacific Rim neighbors Australia and Japan than it does with those still on the upswing (e.g., China, India). However, as global biopharmaceutical manufacturers invest heavily in South Korea’s research sector, care will need to be taken to ensure that local firms maintain their relevance. Only heavy and competitive investment in high-risk next generation technologies (e.g., genetic engineering, cytotherapeutics, immunotherapy, etc.) and a commitment to continual international standards harmonization will ensure sustainable success.

9931

References

- The World Bank (2002) GDP at market prices (current US$). Glossary of Statistical Terms, Organisation for Economic Co-operation and Development, France.

- The World Bank GDP per capita (current US$). Organisation for Economic Co-operation and Development, France.

- OECD (2015) Education at a Glance: OECD Indicators (Korea). OECD iLibrary, France.

- The World Bank (2012) Research and development expenditure (% of GDP). The world Development Indicators, UNESCO, USA.

- BCG Perspectives (2015) The Most Innovative Companies. Boston Consulting Group, USA.

- Harvie C, Lee HH (2003) Export Led Industrialization and Growth-Korea’s Economic Miracle 1962-89. Economics Working Paper 03-01, University of Wollongong, Australia.

- DG Research (2007) Case Study: South Korea. The “Policy Mix” Project-A Study Funded by the European Commission, Netherlands.

- Adelman I (1999) Lessons from (S) Korea. Zagreb International Review of Economics & Business 2: 57-71.

- Krueger A, Lary H, Monson T, Akrasanee N (1980) Export Promotion and Employment Growth in South Korea” in Trade and Employment in Developing Countries 1: 1-15.

- Campbell J (2012) Building an IT Economy: South Korean Science and Technology Policy. Issues in Technology Innovation, The Center for Technology Innovation, USA.

- Galbraith J, Kim J (1998) The Legacy of the HCI: An Empirical Analysis of Korean Industrial Policy. Journal of Economic Development 23: 1-20.

- Powers C (2010) The Changing Role Of Chaebol. Stanford Journal of East Asian Affairs 10: 1-12.

- Baldwin R (1991) Industrial Organization and Trade Liberalization: Evidence from Korea. In Empirical Studies of Commercial Policy, University of Chicago Press, USA.

- Kim S (1996) The Korean system of innovation and the semiconductor industry: a governance perspective. Science Policy Research Unit / Sussex European Institute-Joint Product, England.

- Invest Korea (2015) S. Korea posts record share in DRAM market in Q3. Yonhap News Agency, South Korea.

- Gupta N, Healey D, Stein A, Shipp S (2013) Innovation Policies of South Korea. Institute For Defense Analyses (IDA), USA, pp: 1-71.

- Connell S (2014) Creating Korea’s Future Economy: Innovation, Growth, and Korea-US Economic Relations. Asia Pacific Issues. Honolulu: East-West Cener, USA p: 8.

- Alan G (2014) Why South Korea Will Be The Global Hub For Tech Startups. Forbes/ Entrepreneurs, France.

- International Organization of Motor Vehicle Manufacturers (2015) Production Statistics. Organisation Internationale des Constructeurs d'Automobiles, France.

- KAMA (2014) Korean Automobile Industry Annual Report. Korea Automobile Manufacturers Association, Korea pp: 1-55.

- The World Bank (2016) High-technology exports (% of manufactured exports)”. World Development Indicators: Science and technology, USA.

- The World Bank (2016) High-technology exports (current US$). World Development Indicators: Science and technology, USA.

- Korean Ministry of Education, Science and Technology (2009) Biotechnology in Korea.

- Korea Research Institute of Bioscience & Biotechnology (KRIBB) Website.

- Wong J, Quach U, Thorsteinsdottir H, Singer P, Daar A (2004) South Korean biotechnology-a rising industrial and scientific powerhouse. Nature Biotechnology 22.

- Muralitharan M, Chandler S, Gray C (2005) Current Status of Bioindustry in South Korea. Asia Pacific Biotech News 9: 955-958.

- IBI Research and Consulting Group Ltd (2014) Biotechnology in Korea-Overview, Perspectives & Opportunities for collaboration between Italian and Korean players. Italian Trade Agency (ITA) pp: 1-56.

- Korean Ministry of Science, ICT and Future Planning (2016) Biotechnology in Korea 2013.

- Datamonitor Healthcare (2012) Pharmaceutical Industry Infrastructure Overview (South Korea). Research and Markets Brochure, USA.

- Shim Jw (2009) Drug companies invest to open up export markets. Korea Joongang Daily, Korea.

- Celltrion Press Release (2007) FDA Approves Celltrion to Manufacture ORENCIA® (abatacept). PR Newswire Association LLC, UK.

- Bristol-Myers Squibb Press Release (2013) Bristol-Myers Squibb Reports Third Quarter 2013 Financial Results. Business Wire NewsHQSM, USA.

- Bristol-Myers Squibb Press Release (2014) Bristol-Myers Squibb and Samsung BioLogics Expand Manufacturing Agreement. Business Wire NewsHQSM, USA.

- Virk KP (2010) Korea Path. International Clinical Trials, Samedan Ltd, UK.

- Berndt E, Cockburn I, Thiers F (2007) The Globalization of Clinical Trials for New Medicines into Emerging Economies: Where are They Going and Why? The Globalization of Clinical Trials into Emerging Economies, USA.

- Invest Korea (2014) Promising Investment Opportunities-Biopharmaceutical. Korea Trade-Investment Promotion Agency.

- Donny K (2007) Pfizer looks to expand R&D presence in Asia. Thomson Reuters, USA.

- AJU Business (2011) Daily Big Drug-Maker AstraZeneca to Invest 80 bln won. Ajunews Corporation.

- Korea Pharma Today (2009) Otsuka Pharmaceutical to invest 100 billion won in Korea. The Korea herald Corporation, South Korea.

- Financial Times (2012) Korea’s biotech comeback kid. First Word Pharma, UK.

- DiaDexus Press Release (2010) VaxGen and diaDexus Complete Merger. VaxGenand diaDexus LLC, USA.

- VaxGen Press Release (2002) VaxGen Forms Joint Venture to Build Manufacturing Facilities in California and South Korea. Celltrion Inc, Switzerland.

- Hospira Press Release (2009) Hospira, Celltrion, Enter Business Cooperation Agreement to Develop and Market Biogeneric Drugs. PR Newswire Association LLC, UK.

- Celltrion Press Release (2012) KFDA approves RemsimaTM (infliximab), the world’s first antibody biosimilar.

- Celltrion Press Release (2015) Celltrion launches world's first biosimilar monoclonal antibody Remsima™ in 12 new European markets. Business Wire NewsHQSM, USA.

- Celltrion Press Release (2016) FDA’s Arthritis Advisory Committee Recommends Approval of Celltrion’s CT-P13, a Proposed Biosimilar Infliximab, for All Eligible Indications. Celltrion Inc, Swizerland.

- Pfizer Press Release (2015) Pfizer Completes Acquisition of Hospira. Pfizer Inc., New York.

- Pfizer Press Release (2015) Pfizer Reports Third-Quarter 2015 Results. Business Wire, USA.

- Federal Trade Commission Press Release (2015) FTC Requires Pfizer Inc. to Sell Rights to Four Products as a Condition of Acquiring Hospira, Inc. Federal Trade Commission, USA.

- Marie K (2015) Celltrion Submits Second Biosimilar for Approval to European Regulator. Health care celltrion, Business Korea, Korea.

- Samsung Biologics Press Release (2011) Samsung Stakes Out Biopharma Position. Institution of Chemical Engineers, Ichem E, UK.

- Jonathan C (2015) Samsung to Invest $740 Million in New Biologic Drug Factory. The Wall Street Journal.

- Biogen Press Release (2012) Samsung Biologics and Biogen Idec Announce Formation of Biosimilars Joint Venture Samsung Bioepis. Business Wire, USA.

- Merck Press Release (2013) Merck and Samsung Bioepis Enter Biosimilars Development and Commercialization Agreement. Merck & Co Inc, USA.

- Samsung Bioepis Press Release (2015) Samsung Bioepis, Etanercept Biosimilar, BRENZYS® (SB4) approved in South Korea. Merck Press, USA.

- Merck Press Release (2015) Merck Announces Samsung Bioepis Receives Approval of RENFLEXIS™ (Infliximab), a Biosimilar of Remicade, in Korea. Business Wire, USA.

- Samsung Bioepis Press Release (2015) Samsung Bioepis Receives Positive CHMP Opinion for the First Etanercept Biosimilar in the European Union. Business Wire, USA.

- Samsung Bioepis Press Release (2015) Samsung Bioepis Submits Marketing Authorization Application For SB2, A Remicade (Infliximab) Biosimilar Candidate, To The European Medicines Agency. Biogen Idec, Korea.

- Jonathan C, Min-Jeong L (2015) “Samsung Makes First Foray into US Stock Market with Biotech Listing”. The Wall Street Journal.

- Murray A (2014) Global Outlook for Medicines through 2018. IMS Institute for Healthcare Informatics, USA.

- Umemura M (2012) Globalization and change in the Japanese pharmaceutical industry, 1990-2010. In. Umemura M and Fujioka R (eds) Comparative Responses to Globalization: British and Japanese Enterprises, Basingstoke: Palgrave Macmillan, London.